FAQs – Administrative Services

Do you need some help?

The quickest way to reach us is to contact us through the contact form on the website.

Address:

310 Old Santa Fe Trail,

Santa Fe NM 87501

Phone:

505-827-5760

What revenues have we earned to date?

View the Monthly Revenue Report

What is the difference between the Land Grant Permanent Fund (LGPF) and the Land Maintenance Fund?

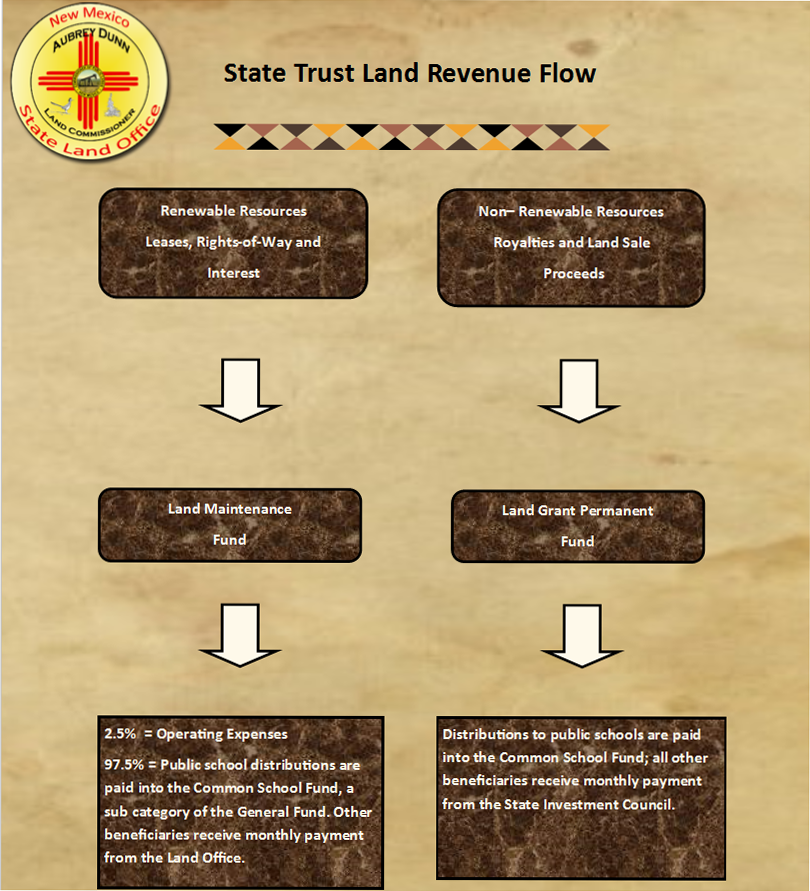

The Land Grant permanent fund receives royalty payments from non-renewable resources (oil, gas and mineral extraction). The State Land Office transfers royalties collected by beneficiary to the State Investment Council (SIC) monthly. The SIC manages the permanent fund and distributes funds to beneficiaries’ monthly based Constitutional provisions and the beneficiaries proportionate share of the fund.

The Land Maintenance Fund is generated by revenue from renewable resources: leases, rights-of-way and interest. State Land Office operating expenses (approved by the Legislature) are paid from revenue collected and the balance is distributed proportionately to the beneficiaries that earned revenue in that month.

How is the beneficiary amount determined?

Each tract of land is tied to a specific beneficiary. Activities (usually documented in a lease or other legal instrument) on the tract of land determine the type of revenue earned – that is whether it is rental income (from rental leasing, bonuses, interest or miscellaneous activity) or royalties (from the sale of land or extraction of minerals). Any activity that generates income from any source is credited to the land/beneficiary that earned that income.

Rental Income is earned through the leasing of land. The amount due each beneficiary depends on the terms of the lease and the activity that generates the income. The income for the month net of SLO expenses is distributed to the earning beneficiary at the end of each month.

Royalty income is based on the extraction of minerals pursuant to a lease and the amounts are lease terms dictate the amount of royalty to be paid. Payments are processed and transferred to the Land Grant Permanent Fund on behalf of the earning beneficiary.

What are the projections for the beneficiaries?

The State Land Office does not publish projections as they could create expectations on the part of the beneficiaries that may not be realized.